Explore the best travel loan apps in the USA, including SoFi, LendingPoint, Upstart, and Discover. Get emergency travel loans with quick approvals, flexible repayment terms, and competitive interest rates.

Traveling can sometimes come with unexpected expenses, and in those moments, access to quick financial help becomes essential.

Whether it’s for a medical emergency, sudden accommodation expenses, or missed flights, having a backup plan, like an instant travel loan, can be a lifesaver.

Best Apps to Get Instant Loan During Travel Vacation

Best travel loan apps in the USA, including details about their loan amounts, approval time, interest rates, repayment terms, and eligibility.

These apps are perfect for securing an emergency travel loan while on vacation.

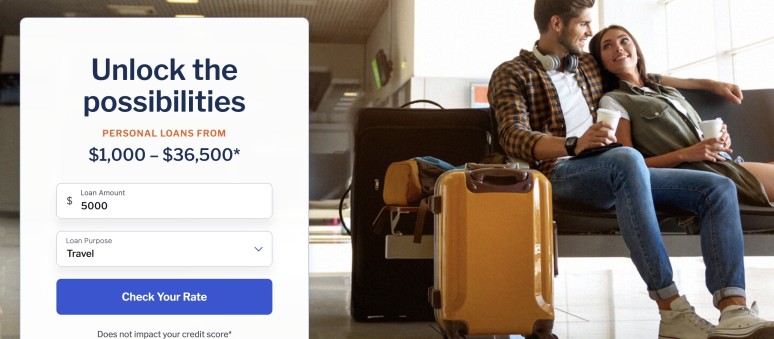

1. SoFi

SoFi is widely known for its low-interest personal loans, ideal for travelers needing instant funds during emergencies.

Key Features:

- Loan Amount: $5,000 – $100,000

- Approval Time: As quick as 24 hours

- Interest Rate: 7.99% – 23.43% APR

- Repayment Terms: 2 to 7 years

- Eligibility Requirements: Minimum credit score of 680, stable income, U.S. citizen or permanent resident

Why SoFi?

SoFi stands out with zero fees for loan processing, origination, and prepayment, making it one of the most affordable options for travelers.

It also offers unemployment protection, where SoFi pauses your payments if you lose your job and helps you find a new one.

2. LendingPoint

LendingPoint is known for its quick approval process, catering to borrowers with fair credit, making it a suitable emergency travel loan option.

Key Features:

- Loan Amount: $2,000 – $36,500

- Approval Time: Same-day or next business day

- Interest Rate: 7.99% – 35.99% APR

- Repayment Terms: 24 to 60 months

- Eligibility Requirements: Minimum credit score of 600, U.S. citizen or resident, annual income of $20,000+

Why LendingPoint?

LendingPoint is excellent for travelers with less-than-perfect credit scores. It provides fast loan disbursals, making it a strong option for sudden vacation expenses.

The flexible eligibility criteria also allow more people to qualify for a loan, even in emergencies.

3. Upstart

Upstart is an innovative platform that uses artificial intelligence (AI) to assess eligibility beyond just your credit score.

This makes it a great solution for young travelers or those with a limited credit history.

Key Features:

- Loan Amount: $1,000 – $50,000

- Approval Time: Next business day

- Interest Rate: 6.7% – 35.99% APR

- Repayment Terms: 3 to 5 years

- Eligibility Requirements: Minimum credit score of 580, no recent bankruptcies, U.S. citizen or resident

Why Upstart?

With a fast approval process and minimal eligibility requirements, Upstart is a solid choice for emergency travel loans.

It considers your education, employment history, and other factors when approving loans, giving more people a chance to qualify even if they lack an extensive credit history.

4. Discover Personal Loans

Discover offers personal loans with flexible repayment terms and no upfront fees, making it another top contender for travel loan apps.

Key Features:

- Loan Amount: $2,500 – $40,000

- Approval Time: 1 to 7 days

- Interest Rate: 6.99% – 24.99% APR

- Repayment Terms: 3 to 7 years

- Eligibility Requirements: Minimum credit score of 660, steady income, U.S. citizen or permanent resident

Why Discover?

Discover Personal Loans provide a wide range of loan amounts, making them ideal for covering both minor and major unexpected travel expenses.

With no origination fees and flexible terms, you can tailor your repayment plan based on your financial situation.

How to Get Emergency Funds During Travel

In addition to applying for loans via these apps, here are some additional ways to secure emergency travel funds:

1. Travel Insurance

Many travel insurance policies offer coverage for unexpected expenses such as medical emergencies, trip cancellations, and lost baggage.

Having travel insurance in place can save you from major financial burdens during unforeseen travel mishaps.

2. Credit Cards with Emergency Loans

Some credit cards offer instant cash advances during emergencies.

Though the interest rates on these advances can be high, they provide immediate funds, often without the need for additional paperwork.

3. Contact Your Bank

Some banks offer short-term personal loans or credit line increases for their customers. If you have a good relationship with your bank, you can request an emergency loan or a credit line extension to cover travel expenses.

4. Borrow from Friends or Family

If all else fails, consider asking for a short-term loan from family or friends. While this can be uncomfortable, it could be a faster and more affordable option than taking out a high-interest loan from a lender.

5. Use a Peer-to-Peer Lending Platform

Apart from the apps mentioned above, you can also explore peer-to-peer lending platforms, which can connect you to individuals willing to lend money directly. These platforms typically have more relaxed eligibility criteria, which can be helpful in emergency situations.

When traveling, it’s always a good idea to be prepared for emergencies, especially financial ones. The apps listed here—SoFi, LendingPoint, Upstart, and Discover—are some of the best travel loan apps in the USA, offering quick approvals, flexible terms, and decent interest rates. Whether you need a small loan for a minor expense or a larger one to cover significant costs, these apps can provide the emergency travel loan you need.